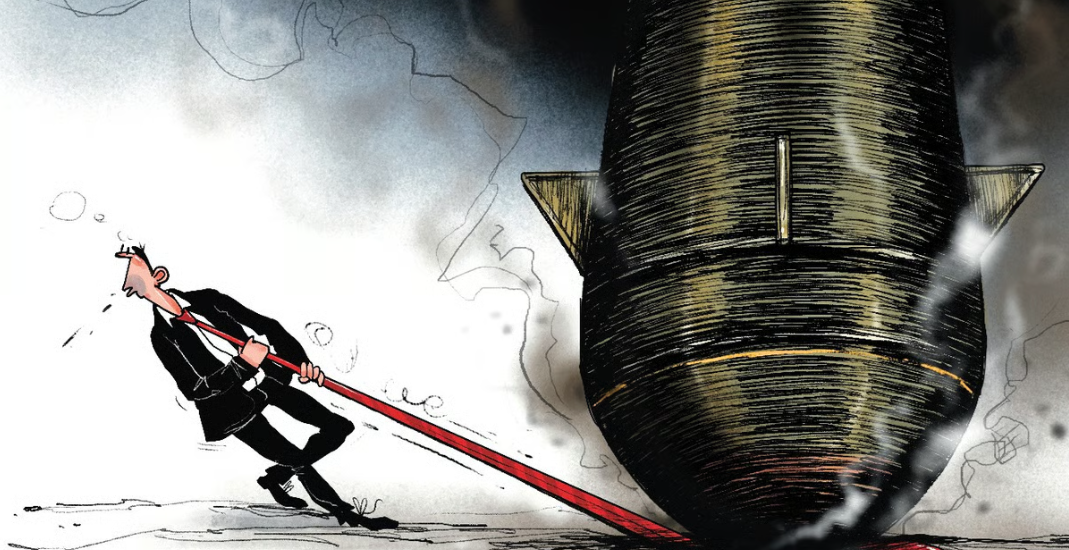

Aiding wars in the hope of achieving peace

- May 28, 2024

- Posted by: admin

- Categories: Israel, Taiwan, Ukraine

The US has recently cleared a $95-bn package for Ukraine, Israel and Taiwan. It’s ironic that there is more aid for fighting than for rebuilding and humanitarian assistance

Satyajit DasUpdated on: 18 May 2024, 7:04 am4 min read

Modern warfare—with its interplay of industry, economics and geopolitics—is too dangerous to leave to generals. War requires massive amounts of equipment, munitions and manpower. Allied success in the two 20th-century world wars was founded on superior industrial capabilities. Western powers are currently struggling to match Russia and China in producing arms for its client states. The US and allies have downgraded heavy manufacturing essential for weaponry in favour of consumer goods and services. In contrast, their opponents have prioritised military manufacturing and maintaining inventories for conflict. Western industrial ecosystems, frequently privatised, now lack the capacity and surge capability.

Economics underlies the ability to sustain conflict. Western-equipped Ukraine and Israel possess superior conventional firepower. But asymmetric warfare and low-tech improvisation using cheap drones and missiles can alter the balance, especially by calibrating escalation of hostilities.

Israel expended an estimated $1.4 billion in munitions and fuel (around 6 percent of its annual defence budget) to repulse Iran’s choreographed attack that cost perhaps $30 million. The Houthis in Yemen have disrupted transport routes using cheap drones. Al-Qaeda’s 911 operation costing less than $500,000 resulted in trillions in losses when the cost of ongoing defence and security spending is considered.

A ‘boys with toys’ syndrome drives a touching faith in expensive high-tech weapons. The difficult-to-maintain-and-operate F35 jets cost around $150 million each. The Patriot air defence system costs over $1 billion, with each interceptor missile costing a further $6-10 million. Heavy battle tanks are $6-10 million each. Individual artillery rounds cost $3,000-5,000. Western weapons are frequently double the cost of Russian and Chinese equivalents. Many have proved ineffective under actual battle conditions as the enemy adjusts its tactics.

Large quantities of low-cost weapons can make better-equipped forces expend substantial resources for limited gains. The objective is to economically weaken the enemy and stretch conflict against opponents with limited appetite for long wars. As Russian leader Joseph Stalin understood, quantity has quality of its own.Play VideoClose Player

Degrading the ability to finance military action is essential. Russia’s targeting of industrial and agricultural infrastructure combined with the displacement of manpower has reduced Ukrainian output by 30-35 percent. The cost of rebuilding is around $500 billion. Ukraine will need to restructure the country’s $20 billion international debt to avoid default.

Obliteration of the impoverished, aid-reliant Gaza is economically pointless except to drive residents out, paving the way ultimately for Jewish settlement. In contrast, Israel’s economy has shrunk, by perhaps 20 percent. Loss of cheap Palestinian labour has crippled construction and agriculture. The call-up of reservists for military service and a flight of talent has disrupted its industries. Israel’s northern border skirmishes have necessitated the evacuation of around 60,000 Israelis, resulting in economic dislocation and relocation costs. The $50-billion-plus cost to date (10 percent of GDP) of the conflict has substantially increased Israel’s debt and its credit rating has been downgraded.

Ukraine and Israel are reliant on Western backers. The US, NATO and their allies have provided Ukraine with over $175 billion in military, financial and humanitarian aid, primarily financed by government borrowings. Many European nations are in breach of EU-mandated debt limits. Since its founding, Israel, despite its high income, has been the largest cumulative recipient of US foreign aid—$300 billion (adjusted for inflation) in total economic and military assistance and loan guarantees. Lip-service to freedom and holocaust guilt notwithstanding, donors cannot afford this. Support is also at risk from domestic laws prohibiting military assistance to nations who violate human rights.

The weaponisation of economics is commonplace. But sanctions on Russia have been ineffective as many nations have helped circumvent them due to financial and ideological incentives. Decades of isolation and wariness of the West mean Russia and China are self-sufficient autarkies with limited dependence on external supply chains. Globally integrated economies, such as Israel, are more vulnerable to reduced foreign investment and sanctions as apartheid South Africa discovered.

Attempts to weaken an enemy economically can backfire. US weapons production is now constrained by supplies of titanium and rare earths from enemies. Having sought to restrict Russian energy output, the West finds itself trying to suppress prices. As the Gaza war shows, economics and geopolitics can intersect with unpredictable long-term consequences.

Regional instability has reduced tourism and traffic through the Suez Canal. Saudi Arabia has experienced difficulty in attracting foreign investment in the NEOM mega-project. An exodus of Palestinians into Egypt and Jordan would destabilise their economies. Affected nations want an urgent solution. The US pushed for Saudi Arabia to normalise relations with Israel, reducing the threat from an united Arab front. Saudi Arabia might get a defence pact with the US and support for nuclear ambitions. It would improve its access to overseas investment and Israeli tech as well as offsetting Iran’s regional influence.

The real unstated imperative is protection of Arab monarchies and their wealth in the West. Given that over 90 percent of their population support the Palestinian cause, a perceived betrayal risks a new ‘Arab Spring’. With rising domestic tensions requiring increasing repressive counter-measures in the Gulf, Egypt and Jordan, civil conflict and the fall of unpopular hereditary regimes is not inconceivable.

Such instability, which investors do not countenance, poses serious risks to global economy. The Gulf states hold 30 percent and 21 percent of global oil and natural gas reserves, respectively. Energy prices would be affected, especially if weaponised as in the 1970s. It would affect Suez Canal trade. Since the start of the Gaza war, the cost of transporting a container from China to Europe has quadrupled from $1,000 to $4,000 and added up to two weeks in travel time.

But if the Arab states unite against Israel, then an escalation in the conflict is also possible, with similar outcomes. Terror actions by non-state actors against Western targets is an ever-present risk.

As Sun Tzu outlined in the Art of War, those wishing to fight must first understand the cost.

(Views are personal)

Satyajit Das | Former banker and author